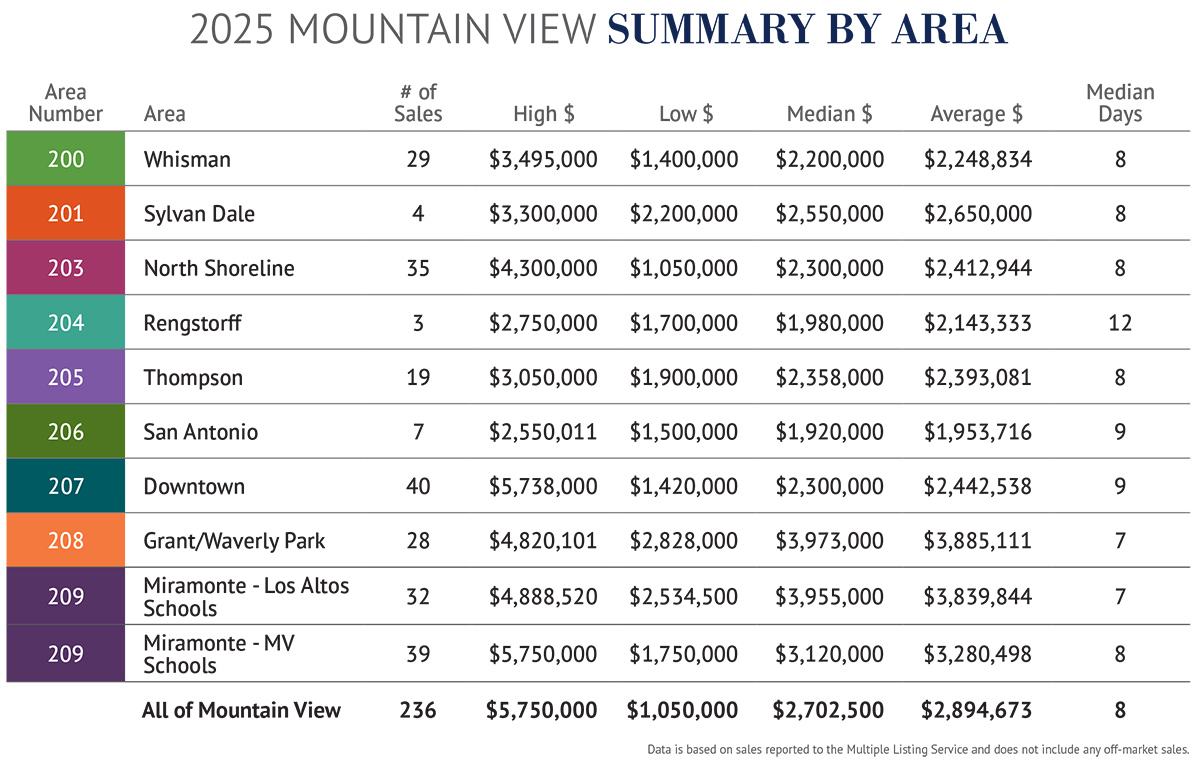

MOUNTAIN VIEW SINGLE-FAMILY HOMES

2025 Annual Report

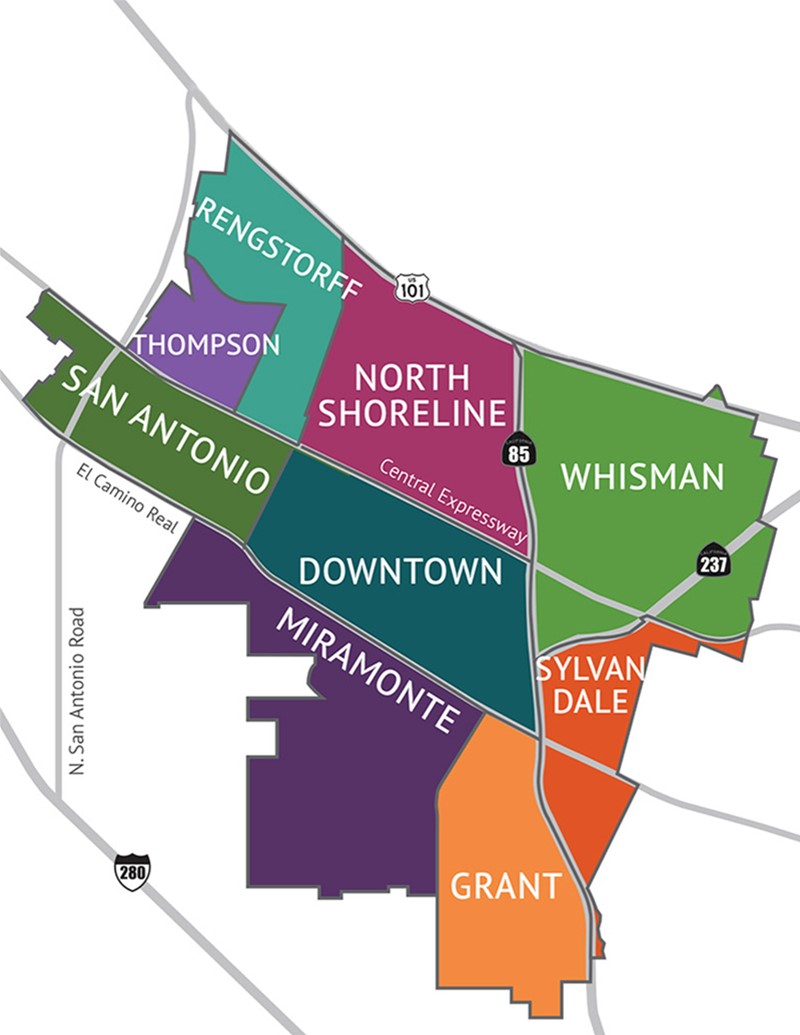

Rollover or click map to see more information for each area.

200 WHISMAN

This area reached a new record high average price, exceeding $2.2 million for the first time. There were 29 sales compared to 21 in 2024 and 20 in 2023. 23 sales, or 79%, were for more than list price – a clear indication of demand. 76% of the sales were for more than $2 million and 2 sales were for more than $3 million.

206 SAN ANTONIO

There were 7 sales in this area but prices were generally lower causing the average price to drop 14% to below $2 million – the first time since 2020. Demand though was evidenced by 5 of the 7 homes selling for more than list price, including the 3 most expensive. Those 3 homes, plus 2 additional homes, sold in 14 days or less.

201 SYLVAN DALE

There were just 4 sales in 2025, following 11 sales in 2024. All homes sold for more than list price and 3 sold in 8 days or less. No homes sold for less than $2.2 million and the average price was up to a new all-time high of $2.65 million. The median price fell to $2.55 million, a 6% drop from the record high of $2.7 million in 2024.

207 DOWNTOWN

As in 2023 and 2024, this popular area had more sales than any other area in Mountain View. There were 40 sales, compared to 45 in 2024 and 40 in 2023. There were 6 sales for more than $3 million, including a new home at $5,738,000, which was by far the highest on record. Despite the high prices, the average price was down 2% and down 8% from the record high in 2022. 25 of the 40 homes, or 63%, sold for more than list price and 23, or 58%, sold in 2 weeks or less.

203 NORTH SHORELINE

Sales were strong here and the average and median price each reached a record high. The average price exceeded $2.4 million for the first time and the median price reached $2.3 million. The high end was strong with 5 sales for more than $3 million, including a record high sale for $4.3 million, and the first sale for more than $4 million. On the opposite end, there were no sales for less than $1 million and just 7 sales for less than $2 million. Homes sold quickly with half selling in 8 days or less.

208 GRANT/WAVERLY PARK

This sought-after area was very strong with 28 sales, 21 of which sold for more than list price, including the 5 most expensive. The average price dropped a slight 1% from the record high in 2024 but the median price reached a record high of more than $3.9 million. There were 13 sales for more than $4 million and no sales for less than $2.8 million. There were 23 homes that sold in 2 weeks or less. Demand was high.

204 RENGSTORFF

There were just 3 sales in 2025 and each sold for more than list price. The average price was down slightly yet still over $2.1 million. Prices have varied here over the past 9 years with averages taking some steep declines in years most often tied to the few number of sales. The length of time to sell a home varied with 2 of the sales occurring in 12 days or less and the other taking 115 days, yet still selling over list price.

209 MIRAMONTE–LOS ALTOS SCHOOLS

This area had the second highest average price in Mountain View with a 5% increase and a new record high for the area exceeding $3.8 million. There were 16 sales for more than $4 million, and all but 4 homes sold for more than list price. There were only 2 homes that sold for less than list price. With demand like this, it’s no surprise that homes sold very quickly – in fact, this area tied with Grant/Waverly Park for the lowest days on market in all of Mountain View.

205 THOMPSON

Sales were strong here with 19 sales in 2025. A significant 15 of the 19 homes sold for more than list price and only 5 took longer than 20 days to sell – all clear evidence of strong demand. The average price was up 7% to a new high of more than $2.3 million. There were 2 sales over $3 million and only 1 sale for less than $2 million.

209 MIRAMONTE–MTN VIEW SCHOOLS

This area had the second highest number of sales in Mountain View and the average price reached a record high, exceeding the $3.2 million for the first time. Demand was exceptionally strong with only 4 homes selling for less than list price. The average home sold for 107% of list price. There was a record high sale at $5,750,000. Homes sold very fast with 30 of the 39 sales, or 77%, selling in 2 weeks or less.

RECAP OF 2025

- Record high average and median price

- Average price up 4%; median price up 2%

- 3 homes sold for more than $5 million

- 74% sold over list price (compared to 71% in 2024)

- Homes sold very quickly; 44% in 7 days or less and 73% in 2 weeks or less

- 6 of the 10 areas had record high prices

NUMBER OF SALES

There were 236 single-family homes sold as reported through the Multiple Listing Service in 2025. This was a decline of 7% yet still higher than the all-time low of 219 in 2023.

There were an additional 283 condos/townhomes sold in Mountain View, which are not included in this report.

PRICES

Prices increased again in 2025 with both the average and median price reaching record highs. The average price rose 4% from the previous year, exceeding $2.8 million for the first time. The median price increased 2% to a new high over $2.7 million for the first time. As the year went on, prices increased. In the first half, the average was $2,875,209; in the second half, the average price was $2,915,503. The median price was more balanced throughout the year.

The highest end of the market was strong with 36 sales for more than $4 million (compared to just 26 the previous year). This included 3 sales for more than $5 million, the most expensive, at $5,750,000, being the second-highest price on record in Mountain View.

There were 175 homes, or 74%, that sold for more than list price. There was a shift between the first and second halves with 78% over list price in the first half and 70% in the second half.

LENGTH OF TIME TO SELL

Again, homes sold very fast in 2025, a clear indication of demand. 44% sold in 7 days or less and 73% sold in 2 weeks or less. There were only 30 homes that were on the market for more than 30 days.

There was a direct correlation between days on market and price. For the 22 homes that were not accurately priced when listed and therefore required a price reduction, the average days on market was 46. All other homes had average days on market of just 12. Setting the correct price based on local market knowledge and conditions is essential to obtaining maximum value and a timely sale.

OUTLOOK

In our report to you last year, we anticipated a more balanced market. It turns out it was indeed a seller’s market with record-high average prices. Demand for Mountain View homes was exceptional and we expect that demand to continue into 2026. Property values are projected to show continued growth, and the number of home sales is anticipated to increase at a moderate pace.

Mortgage rates are forecasted to remain around the low-6% range through 2026, with many analysts expecting them to hover near 6.0%–6.5% on a 30-year fixed mortgage and only modest declines through the end of the year. Periodic dips below 6 percent could provide a modest boost to buyer confidence and transaction activity.

That said, in Silicon Valley, interest rates typically play a smaller role than in many other markets. Buyers often rely on significant financial flexibility – including cash holdings, equity from prior sales, or stock-based compensation – reducing dependence on conventional mortgage financing. As a result, local market behavior continues to be driven primarily by inventory, competition, schools, and the appeal of individual properties rather than rate volatility.

For buyers, decisiveness will remain critical when well-located, well-priced homes come to market, particularly in highly competitive neighborhoods. Sellers continue to benefit from solid demand, but results will depend on careful pricing, presentation, and timing – areas where Troyer & Cabot Group provides a clear advantage.

As always, real estate is a deeply local business, with conditions varying significantly from one neighborhood to the next. By staying attuned to these local nuances and understanding the latest trends – guided by Troyer & Cabot Group, buyers and sellers can navigate the 2026 market with confidence. We remain optimistic on the long-term value of owning a home in Mountain View, which continues to be one of the best places to live in the Bay Area. If you would like more information on any of the information in this report, or if you would like to discuss your specific real estate needs, please give us a call.

The Troyer & Cabot Group represented buyers and sellers of 21 Mountain View homes in 2025. It’s results like this that place The Troyer & Cabot Group as the #2 Large Team in Northern California and #14 in the United States, per RealTrends, 2025.

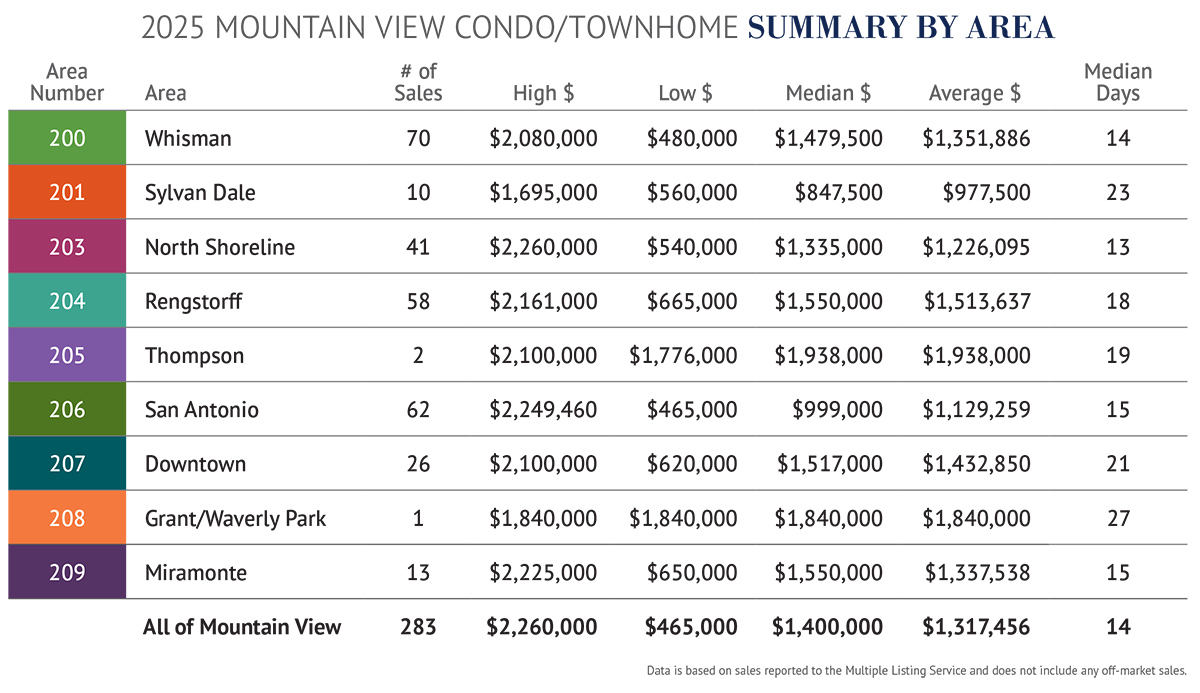

Mountain View Condos/Townhomes

2025 Annual Report

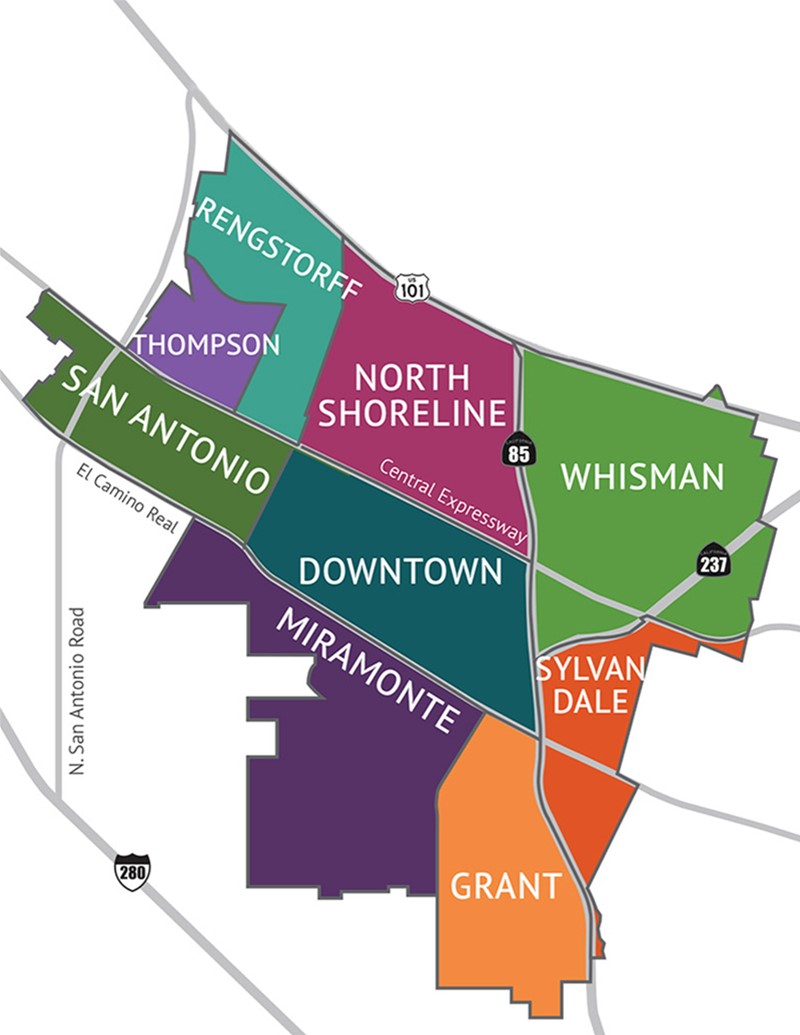

Rollover or click map to see more information for each area.

200 WHISMAN

This area had the highest number of sales, by far, in any area of Mountain View. There were 70 sales, which was up from 66 sales in 2024 and 53 in 2023. The average price was down just slightly from 2024, remaining over $1.3 million for the fourth year in a

row. There was 1 sale above $2 million and 57% of the homes sold over list price. Homes sold quickly with one of the lowest days on market in this report.

206 SAN ANTONIO

This area had the second-highest number of sales for any area in Mountain View. There were 62 sales, compared to 64 in 2024. The average price was a record high, exceeding $1.1 million for the first time. 47% of the homes sold over list price and half sold in 15 days or less. A record high individual sales price was reached at $2,249,460.

201 SYLVAN DALE

There were 10 sales here compared to 7 in 2024. Because 6 of the sales were for less than $1 million, the average price fell below $1 million for the first time since 2014. However, it is important to note that 3 of the homes for more than $1 million, sold for more than list price and very quickly. Half of the homes were on the market for 11 days or less, but the average days on market was 25.

207 DOWNTOWN

Sales rose sharply in this area with 26 sales compared to 16 in 2024 and just 7 in 2023. The average price was up 7% and over $1.4 million but still not to the record high set in 2021. There was just 1 sale for more than $2 million and 3 sales for less than $1 million. Homes varied for length of time on the market but with 11 taking 30 days or more to sell, this area’s median days on market was 3 weeks.

203 NORTH SHORELINE

There were 41 sales here compared to 62 sales in 2024. The average price reached a record high, rising 9% to more than $1.2 million. A new individual record high was reached at $2,260,000, which sold for far more than list price. There were 22 homes, or 54%, that sold over list price and another 6 that sold at list price. The median days on market was 13, the lowest of any area in Mountain View.

208 GRANT/WAVERLY PARK

This area has very few condos/townhomes; there was just 1 sale in 2025, no sales in 2024, and 1 sale in 2023. The home was on the market for 27 days but sold slightly more than list price at the end of the year.

204 RENGSTORFF

There were 58 sales in this area, a 14% increase from 2024. The average price was down 5% but still remained above $1.5 million. There were 7 sales for more than $2 million. 69% of all sales were for more than list price and 47% of all sales were in 14 days or less.

209 MIRAMONTE

There were 13 sales in this area, compared to 9 sales in 2024. 7 sales were for more than $1.5 million, including one exceeding $2 million and setting a record high individual price at $2,225,000 – 17% over list price. The average price was up 4% and over $1.3 million but not quite to the record high set in 2021. There were 9 sales, or 69%, that were for more than list price.

205 THOMPSON

This area has just a few townhome complexes so it is not uncommon for the number of sales to be low. There were just 2 sales compared to 5 in 2024. One was over $2 million and one was less than $2 million, resulting in a record high average price. The more expensive home took 32 days to sell, for less than list price, and the other home sold in just 6 days for 18% more than list price.

RECAP OF 2025

- Record high average and median price

- Average price up 3%; median price up 7% to $1.4 million

- Number of sales up ever so slightly

- 14 homes sold over $2 million; 84 sold for less than $1 million

- 57% sold over list price

- Homes took longer to sell; highest days on market since 2012

NUMBER OF SALES

There were 283 sales of condos/townhomes reported through the Multiple Listing Service in 2025, just 3 more than in 2024. Sales were much stronger in the second half of the year with 155 sales compared to 128 in the first half.

There were an additional 236 single-family homes sold in Mountain View, which are not included in this report.

PRICES

After 7 consecutive years of the average price staying in the $1.2 million price range, the average price exceeded $1.3 million in 2025. This was a 3% increase from 2024. The median price was even stronger with a 7% increase to a dramatic new high of $1.4 million.

The highest percentage of sales, 41%, were homes sold for more than $1.5 million. 30% of the sales were in both the price range of $1 million to $1.5 million and in the range of homes sold for less than $1 million.

There were 160 homes, or 57%, that sold over list price. On average, condos/townhomes sold for 103% of list price, compared to 104% in 2024.

LENGTH OF TIME TO SELL

Homes took longer to sell in 2025 at a median days on market of 14, but this was the longest days on market since 2012. 72 homes, or 25%, sold in one week or less; 146 homes, or 52%, sold in 2 weeks or less. There were, however, 86 homes that were on the market for more than 30 days before selling.

There was a direct correlation between days on market and price. For the 56 homes that were not accurately priced when listed and therefore required a price reduction, the average days on market was 51. All other homes had average days on market of just 19. Setting the correct price based on local market knowledge and market conditions is essential to obtaining maximum value and a timely sale.

OUTLOOK

In our report to you last year, we anticipated a more balanced market. It turns out it was indeed a seller’s market with record-high average and median prices. Demand for Mountain View condos and townhomes was strong, particularly in the second half, which bodes well for 2026. Property values are projected to show continued growth, and the number of home sales is anticipated to increase at a moderate pace.

Mortgage rates are forecasted to remain around the low-6% range through 2026, with many analysts expecting them to hover near 6.0%–6.5% on a 30-year fixed mortgage and only modest declines through the end of the year. Periodic dips below 6 percent could provide a modest boost to buyer confidence and transaction activity.

That said, in Silicon Valley, interest rates typically play a smaller role than in many other markets. Buyers often rely on significant financial flexibility – including cash holdings, equity from prior sales, or stock-based compensation – reducing dependence on conventional mortgage financing. As a result, local market behavior continues to be driven primarily by inventory, competition, and the appeal of individual properties rather than rate volatility.

For buyers, decisiveness will remain critical when well-located, well-priced homes come to market, particularly in highly competitive neighborhoods. Sellers continue to benefit from solid demand, but results will depend on careful pricing, presentation, and timing – areas where Troyer & Cabot Group provides a clear advantage.

As always, real estate is a deeply local business, with conditions varying significantly from one neighborhood to the next. By staying attuned to these local nuances and understanding the latest trends – guided by Troyer & Cabot Group, buyers and sellers can navigate the 2026 market with confidence. We remain optimistic on the long-term value of owning a home in Mountain View, which continues to be one of the best places to live in the Bay Area. If you would like more information on any of the information in this report, or if you would like to discuss your specific real estate needs, please give us a call.

The Troyer & Cabot Group represented buyers and sellers of 21 Mountain View homes in 2025. It’s results like this that place The Troyer & Cabot Group as the #2 Large Team in Northern California and #14 in the United States, per RealTrends, 2025.